San Antonio’s medical market is bustling, and private practices can attract serious attention when up for sale. Every practice has unique strengths, from loyal patients and consistent revenue to specialty services and experienced staff, which can influence buyer interest. Understanding the process, knowing medical practice valuation, and preparing for a smooth transition in San Antonio, Texas, can turn a complex process into a clear path.

Table of Contents

ToggleAntonio Medical Market at a Glance: Why Timing Matters

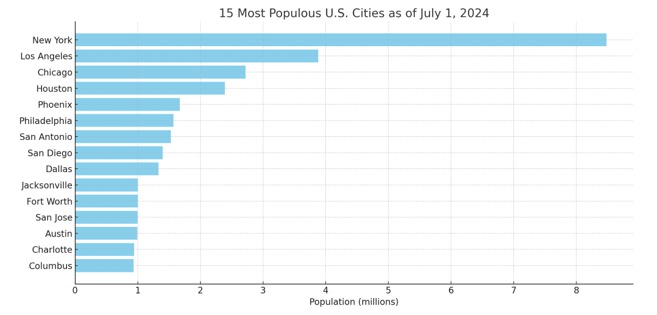

San Antonio added 23,945 new residents last year alone, and the 65+ crowd grew even faster, creating a larger pool of patients with increased healthcare needs. More patients mean higher revenue potential for the next owner and make your practice more attractive in a competitive market. Hospitals, healthcare networks, and private equity groups are actively seeking solid practices in South Texas, making now an ideal moment to consider a sale.

According to a report published by San Antonio Culture Map, the city added more residents, solidifying its spot as the seventh-largest U.S. city.

San Antonio ranks as the 7th-largest U.S. city with over 1.5 million residents in 2024. This growing population fuels steady patient demand, making local medical practices highly attractive to buyers.

If your financial records are well-organized, your patient panel remains active, and your staff is stable, you sit in the driver’s seat during negotiations. Buyers notice clean books, consistent revenue, and a loyal patient base, giving you leverage to achieve a favorable sale price and a smoother transition. Acting strategically now positions your practice for maximum value in this booming local market.

A Complete Guide to Medical Practice Sales in San Antonio

This step-by-step guide walks you through key actions to maximize the value of your practice while keeping operations steady during the transition.

Step 1: Organize Financial Records

Before speaking with potential buyers, your financial records must be clear and up to date. This includes income statements, balance sheets, tax returns, accounts receivable, payer mix details, and an inventory of equipment and other tangible assets. Buyers need a complete financial history to accurately evaluate the practice.

Documents for leases or property agreements, staff employment contracts, and patient records (in compliance with privacy regulations) are also essential. Proper documentation helps a buyer assess the stability and value of your practice.

Step 2: Understand Practice Valuation

“How do you calculate the value of a medical practice in Texas?” Valuation is central to any sale. Private practices are usually valued using several approaches:

- Revenue multiple method: This method estimates value as a portion of annual revenue. Many general practices, according to a Health Leaders Media report, sell for 0.5 to 0.7 times their yearly revenue.

- Earnings-based method (EBITDA or SDE): This method looks at adjusted earnings before interest, taxes, depreciation, and amortization, or seller’s discretionary earnings. Multiples depend on specialty, size, and profitability.

- Goodwill and intangible value: Intangible assets such as patient loyalty, reputation, referral networks, and a consistent payer mix often account for a large share of a practice’s value.

Combining these methods provides a balanced estimate for medical practice valuation in San Antonio, Texas. Formal appraisals often use market comparables and blends of revenue, earnings, and intangible value.

Step 3: Set Realistic Expectations

Understanding what your practice might sell for is essential. Specialty practices with strong profit margins and steady cash flow may attract higher offers. Stable revenue and loyal patients increase the practice’s perceived value. Buyers pay close attention to a few specific drivers that can swing the final number by hundreds of thousands of dollars.

A clean payer mix matters more than most doctors realize. In San Antonio, buyers also reward clinics that have already shifted volume to higher-reimbursing Medicare Annual Wellness Visits and chronic-care management codes.

Step 4: Prepare for Buyer Due Diligence

Once buyers express interest, they will conduct a detailed review. Expect requests for financial records, revenue history, accounts receivable, payer mix, patient retention data, lease documents, staff contracts, equipment lists, and information about liabilities.

Buyers always conduct thorough due diligence in Texas medical practices before finalizing any deal. When sellers prepare their records early, it actually protects both parties by uncovering issues upfront instead of at closing.

Clean and accurate records help maintain confidence in your asking price. Buyers may also require an independent appraisal before making an offer.

Step 5: Engage Multiple Buyers and Consider Brokers

Limiting your sale to a single buyer may reduce your negotiating power. It is smart to approach hospitals, clinics, competitors, or investors. Multiple offers create competition and can improve the final price.

Working with experienced brokers simplifies the process. Medical business brokers like Strategic Medical Brokers can help you find legitimate buyers, manage paperwork, and negotiate terms effectively. Our expertise is valuable in navigating regulations, valuations, and potential buyer vetting.

Step 6: Negotiate Price, Transition, and Goodwill

Negotiation involves more than price. Terms may include the duration of patient transition, which assets are included, staff contracts, lease arrangements, and patient record transfers in compliance with privacy laws.

Goodwill often represents a large portion of value. Buyers may pay extra if the practice has a strong reputation, steady patient flow, and consistent earnings. Historical patient retention, referral networks, and payer stability support goodwill valuation.

Step 7: Handle Legal and Regulatory Requirements

Health-care sales require compliance. In San Antonio, you must comply with privacy laws, record-keeping regulations, and employment rules. Review contracts, lease agreements, and payer arrangements carefully.

Tax and legal advisors can ensure proper structure, asset allocation, and handling of goodwill. A professional valuation report is often included in the sale documentation for credibility.

Step 8: Ensure Smooth Transition for Patients and Staff

A smooth handover preserves patient continuity and protects goodwill. Inform staff early, communicate changes to patients, and transfer records in accordance with regulations.

If the buyer is another physician or a healthcare organization, keeping patients engaged maintains revenue and protects the practice’s reputation. This step is key to the medical practice transition in San Antonio.

FAQs

Value is based on revenue, adjusted earnings, goodwill, patient base, assets, and market comparables, and is often confirmed through a professional appraisal.

Organize financials, assess value, engage buyers or brokers, conduct due diligence, negotiate terms, ensure legal compliance, and manage a smooth transition.

Private medical practices in Texas can generate strong profits, with average margins typically between 10% and 30%, though results vary widely depending on specialty. Factors such as the practice’s focus, geographic location, and management efficiency play a major role in profitability.

As of December 2025, estimates suggest that a private‑practice owner in Texas typically earns more than $80,306, depending on revenue, expenses, and patient load, according to ZipRecruiter.

Wrapping Up

Selling a private practice in San Antonio can be a smart move when approached with clarity and strategy. Knowing your practice’s actual value, organizing your records, and planning the transition carefully ensures both you and your patients come out ahead. The right preparation transforms the sale into an opportunity, not just an end, allowing your legacy to continue while unlocking the financial rewards you deserve.

Your medical practice for sale in Texas deserves the best exposure. We connect you with buyers, handle paperwork, and ensure a smooth, successful closing.