Thinking about when is the right moment to sell your private medical practice in New York is more than just a matter of picking a year on the calendar. It involves reading market cycles, gauging your own readiness, understanding financial trends, and preparing strategically.

Understanding these paths is part of knowing when the time is right. The notion of physician succession planning plays a core role here. If you’re pondering that next chapter, let’s unpack the best moments to pull the trigger.

Table of Contents

ToggleBest Time to Sell a Medical Practice in New York

New York’s medical scene pulses with energy. However, selling here requires a keen eye for local quirks, such as soaring real estate costs and a surge of private equity players seeking opportunities. The sweet spot? When the stars align between booming demand and your personal bandwidth.

Currently, in 2025, buyers are hungry, thanks to an aging population and shifts in tech-savvy healthcare post-pandemic. Yet, it’s not one-size-fits-all. Let’s break down the signals that scream “go time.”

1. When Market Winds Are Blowing Your Way

Keep an ear to the ground for those economic gusts that lift seller boats high. In New York, private equity firms have been on a tear, snapping up practices left and right. A study by Private Equity Stakeholder indicates that deals are closing faster than a subway door, with investors eyeing specialties like cardiology for their steady revenue streams in 2021. Heart disease remains the top cause of death in the U.S., costing over $200 billion each year in medical expenses and lost productivity. The market remains highly fragmented, making it an attractive target for private equity firms that focus on consolidation to drive profits.

2. When Your Practice Hits Peak Performance

No point selling a sputtering engine. The prime moment often arrives when your operation shines brightest, metrics gleaming like a freshly polished stethoscope. In New York, where urban density packs in referrals, a well-oiled machine can fetch premiums that rural spots only dream of.

Timing this peak means auditing your setup six to 12 months in advance. Trim fat from overhead, spruce up records, and poach a bit more from nearby competitors. When everything clicks, that’s your launchpad. And remember, in a city obsessed with metrics, transparency wins bids.

3. When Personal Signals Point to Ready

Markets matter, but your gut clock ticks loudest. Burnout hits hard in New York’s grind, with extended hours and sky-high malpractice premiums taking a toll on individuals. If you’re eyeing 65 or feeling the pull of grandkids’ soccer games, that’s your internal alarm. Doctors who sell at this juncture often report the clearest heads and happiest transitions.

Layer in family dynamics, too. Syncing with the life beats ensures the sale feels like liberation, not escape. Physician succession planning begins here, mapping who will take the baton so your legacy endures without drama.

Indicators That It Might Be Time to Sell

1. Consistently Growing Profit & Cash Flow

One of the most apparent signs that the market will view your practice favorably is when your profit and cash flow consistently trend upward year after year, with minimal fluctuations. Buyers, especially institutional ones, want predictability. A stable or increasing EBITDA makes your numbers credible. Valuation multiples are typically applied to EBITDA. If your numbers are still volatile, small, or closely tied to your personal work, buyers may heavily discount them.

2. Saturating Your Growth Possibilities

If your geographic area is “maxed out” or you’ve saturated your referral network, your best growth would require a significant capital or scale shift. That is a moment to consider selling. When your practice’s ceiling is more about scale than operations, buyers may see you as a ripe acquisition target.

3. Favorable Market Conditions

There are times when capital is plentiful, interest rates are moderate, and private equity or strategic buyers are active. Those are windows of opportunity. The sector is currently experiencing renewed interest. Timing your sale during phases of high M&A activity can result in better multiples and more competitive bids.

4. Personal or Lifestyle Considerations

You may be nearing retirement, want to reduce clinical hours, or seek a less stressful pace. Often, that internal readiness aligns with an external opportunity. If your energy, time, or vision no longer align with the demands of running a practice, that may be your signal. Exit planning for medical professionals is more than financial; it is personal.

What Percent of Doctors Own a Private Practice

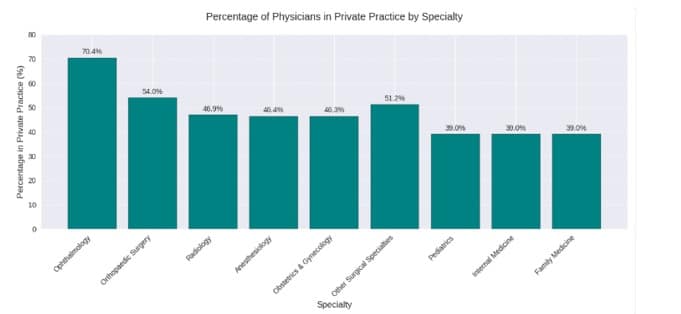

Think about what percent of doctors own a private practice these days. In 2025, according to a report in NCBI, the current percentage of physicians employed in private practices is 55%, representing a 3% decrease from 2015.

The bar graph below, from a study at the American Medical Association, illustrates the percentage of physicians in private practice by specialty, with Ophthalmology topping the list at 70.4% and primary care specialties averaging around 39%. It highlights how surgical specialties generally have higher rates of private practice ownership compared to primary care fields.

In New York, that squeezes up the value of holdouts like yours. Buyers see rarity, and they’re willing to pay. If your practice hums along with strong collections and minimal debt, this could be your cue.

However, don’t overlook the flip side. Regulatory tweaks from Albany could cool things off by year’s end. So, if your numbers are trending up, strike while the buzz lasts.

Best Time for a Private Medical Practice Sale in NY

In New York, the best time often aligns with strong local healthcare demand, a stable regulatory climate, and active M&A interest in the region. That said, you want to step in when:

- Your financials are clean

- You have demonstrated growth in that local market

- There is evidence of buyer interest in your specialty or region

- The broader healthcare M&A environment is positive

For New York specifically, timing just ahead of consolidation waves or when health systems are expanding gives you a competitive advantage.

One further pointer is to observe local competitors or peers. If practices in your city or region are being listed and sold, check “medical practice for sale in New York” listings, which can be a signal that local momentum is aligning. Use that to calibrate your own timeline rather than competing purely on guesswork.

FAQs

From listing to close, expect a timeframe of 6 to 12 months. Rushed deals invite headaches, so build buffer time.

Private medical practices typically sell for 3 to 8 times EBITDA, depending on the specialty, size, and profitability.

Prepare clean financials, demonstrate growth potential, reduce owner dependency, and work with an experienced broker to negotiate favorable terms with private equity buyers.

Document operations, build a reliable team, stabilize revenue, and market your practice through a professional adviser to attract qualified buyers.

Final Thoughts

The best time to sell a private medical practice in New York is a mix of internal readiness and external market opportunity. You want your financials to be clean, growth prospects to be clear, dependence to be minimized, and buyer interest to be active. You’ve poured your heart into this work. Now, claim the reward with eyes wide open. The city’s yours to leave on a high note.

Ready to map your path forward and sell your medical business? Reach out to Strategic Medical Brokers for a quick chat and turn your practice into your next great story.