If you’ve built a solid medical practice in Texas over the years, you might find yourself pondering the next chapter. Maybe retirement is on the horizon, or perhaps you just want to cash in on all that hard work while things are going strong. Selling a practice isn’t something you rush into, but timing it right can make a huge difference in what you walk away with.

In this blog, we’ll chat about the ins and outs of finding that sweet spot for a sale, especially in the Lone Star State, where the healthcare scene is buzzing with changes. Stick around, because by the end, you’ll have a clearer picture of when to pull the trigger.

Table of Contents

ToggleRecognizing the Perfect Window to Sell Your Medical Practice

Deciding on the perfect moment to sell feels personal, but it’s also tied to bigger forces like the economy and industry shifts. In Texas, with its booming population and growing demand for care, the landscape offers some real opportunities if you play it smart.

Let’s break it down into key areas that can guide your choice.

1. Gauging Current Market Conditions in Texas

Texas healthcare is evolving fast, and 2025 brings a wave of activity that could favor sellers. Think about the surge in healthcare acquisitions as hospitals and private equity groups snap up practices to expand their reach. A report from the American Board of Family Medicine shows a deal flow picking up, especially in specialties like primary care and pain management, driven by an aging population and urban growth in places like Dallas and Houston. If your practice sits in a high-demand area, now might align well with buyers looking to consolidate.

One thing to watch is how these healthcare acquisition trends play out locally. For instance, smaller outfits are getting scooped up quicker as larger players build networks. This isn’t just hype; data from mid-2025 published in PWC points to a 35% jump in behavioral health deals alone, spilling over into general practices.

Selling during this uptick means more interest and potentially better offers. Moreover, keep an eye on regional growth as cities like Austin and San Antonio are hot for expansion.

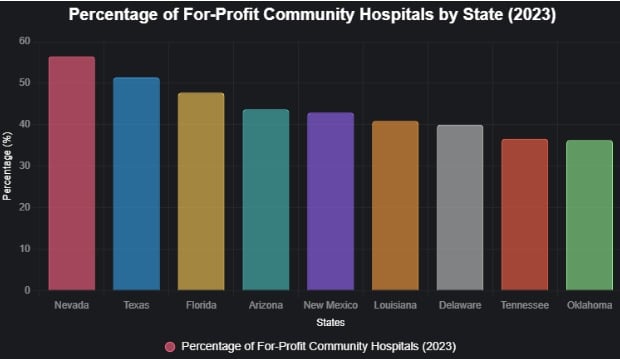

This bar chart, using data from Becker’s Hospital Review, highlights the share of for-profit community hospitals across nine states, with Nevada at 56.5% and Texas close behind at 51.4%. Texas’s strong for-profit hospital presence signals active healthcare acquisitions and may increase buyer interest in a medical office sale.

Timing your move with these market waves can boost your leverage without waiting too long for a potential slowdown.

2. Evaluating Your Practice’s Financial Readiness

Before you list, take a hard look at the books. A healthy bottom line attracts serious buyers, and in Texas, where competition is fierce, numbers talk. Start with basics like revenue stability and patient retention. If your practice has steady growth, say from loyal referrals, that’s gold.

For Texas practices, factors like lower overhead in suburban areas can push that higher. If your margins are dipping, shore them up first, maybe by streamlining billing or cutting non-essential costs. Buyers scrutinize this, so aim to show at least two years of solid financials.

Use this to highlight quick ROI for buyers:

- Review key metrics: Track patient volume and payer mix.

- Boost appeal: Update equipment to justify higher asks.

- Consult experts: Medical practice consultants in Texas can refine your financial story.

A strong financial profile not only speeds up the process but also pads your payout.

3. Weighing Personal and Operational Factors

Selling isn’t all numbers; it’s about you, too. Are you burned out from long hours, or excited for new adventures? Many docs sell when the practice runs smoothly without them glued to it daily, signaling it’s ready for handover. In Texas, with its vast geography, think about relocation ease if you’re eyeing a move to the coast or the hill country.

Operationally, ensure your team is stable and records are tidy. Buyers want seamless transitions, especially with Texas Medical Board rules on patient notifications. If you’re dealing with a medical office sale, factor in real estate values, which are climbing in metros.

Personal timing often syncs with life milestones, like kids finishing school or health shifts. Sell while you’re energized, not exhausted, to keep the process positive. Aligning personal readiness with a thriving operation sets the stage for a smooth exit.

4. Navigating Economic and Regulatory Shifts

Prospective sellers often circle back to core concerns. Specialties like a pain management practice for sale are hot, with Texas listings showing robust interest. The Texas economy influences everything, from reimbursement rates to buyer financing.

A Deloitte survey shows that in 2025, over 70% of health system executives worldwide are prioritizing efficiency, productivity, and patient engagement.

Regulatory hurdles, such as Stark Law compliance, demand clean audits before listing. In Texas, the corporate practice of following medicine rules adds layers, so loop in attorneys early. Economic upswings favor sellers, so monitor job markets and housing trends that draw physicians.

- Track reimbursements: Stable payer contracts sweeten deals.

- Stay compliant: Audit for HIPAA and billing issues.

- Time it right: Avoid year-end tax rushes.

These shifts can tip the scales, so stay informed. Chatting with medical brokers who know the ropes can clarify options. Strategic Medical Brokers can handle the nitty-gritty, from marketing to negotiations, saving you headaches.

FAQs

You’ll typically prepare financial statements, patient lists (anonymized), leases, and compliance records. Texas requires patient notification forms, too.

It usually takes six to twelve months, depending on preparation and market conditions.

Valuations often land at 0.5 to 0.7 times annual earnings, but specialties vary. A general practice might fetch $500,000 to $1 million, while a niche could go higher with proven revenue.

Most medical practices run at an average profit margin of around 15%, but optimize to stand out.

Many practices reach profitability within six months to a year of consistent operations and good marketing.

It accelerated telehealth adoption, boosting values for adaptable practices, though some saw dips in procedure-based specialties.

Concluding Remarks

Finding the best time to present your medical practice for sale in Texas boils down to blending market opportunities, solid finances, personal timing, and external factors. With 2025’s active acquisition scene and Texas’s growth, acting when your practice peaks can lead to rewarding outcomes. It’s not just about the money; it’s about closing one chapter on your terms and opening another. Take stock, consult pros, and move when it feels right. You’ll look back knowing you timed it perfectly.

Ready to make the move? Contact Strategic Medical Brokers today for expert guidance and a confidential valuation. Let’s discuss how we can help you achieve a successful transition tailored to your goals.