Colorado’s healthcare system stands at a fascinating crossroads. Independent practices that once thrived quietly are now part of broader conversations about access, value, and sustainability. For doctors planning medical sales in Colorado, recognizing how these statewide trends influence pricing, demand, and buyer expectations has never been more critical.

Table of Contents

ToggleTrends Reshaping Colorado’s Medical Market and Their Impact on Physicians

Selling a medical practice is rarely just about finding a buyer; it’s also about finding the right buyer. It is about understanding the pulse of the market around you. In Colorado, the healthcare environment is shifting fast, driven by population growth, changing patient expectations, and hospital consolidation.

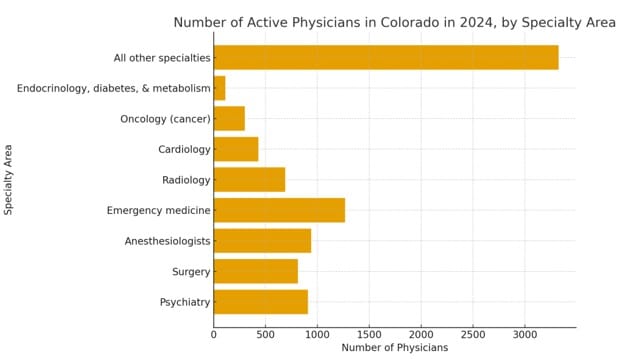

The data from Statista shows the number of active physicians in the state of Colorado in 2024.

The chart shows that emergency medicine and anesthesiology have strong representation among Colorado physicians, while specialties like endocrinology and oncology remain relatively limited, signaling potential gaps in specialized care availability. Recognizing these gaps in specialized care can help physicians strategically position their practices, highlighting high-demand services to attract prospective patients more quickly.

For any physician considering medical sales in Colorado, staying informed about these evolving trends can mean the difference between a quick sale and a prolonged waiting game.

1. Colorado’s Expanding Healthcare Footprint

Colorado’s healthcare system is one of the state’s most significant economic engines. A recent study by the Common Sense Institute estimated that Colorado’s healthcare system generates approximately $148 billion in annual output, supports over 744,000 jobs, and ranks 13th nationwide for overall performance, despite rising costs.

Such numbers reveal why healthcare continues to draw investment interest. Buyers looking for stable, recession-resistant assets are increasingly targeting physician-owned practices. A thorough medical practice analysis can demonstrate how your clinic aligns with this rapidly evolving ecosystem. For sellers, understanding where their service model aligns with market gaps can make negotiations far more productive.

2. Workforce Shortages and Patient Access Gaps

Colorado’s expanding population is outpacing its supply of healthcare professionals.

According to Deutchman in a CPR News article, about two-thirds of Colorado’s 64 counties are classified as ‘rural’ or ‘frontier,’ with nearly all experiencing a shortage of primary care providers. Less than 10 percent of Colorado’s physicians practice in the state’s rural areas.

This shortage presents real healthcare opportunities in Colorado for private practices, particularly in rural settings. Clinics that serve underserved regions, accept a broad payer mix, or offer specialty services can attract buyers seeking community reach and long-term patient loyalty. For a physician considering an exit, these demographic details can significantly impact the valuation of their practice.

3. The Financial Pressures Behind Every Sale

Even strong markets have headwinds. Hospitals and private practices across Colorado are facing higher operating costs and tighter reimbursement margins. Reports from Colorado Hospital Industry Update (2022) indicate that Colorado hospitals’ total expenses in 2022 were 21% higher than pre-pandemic levels, exceeding the growth in reimbursements. Increases in staffing costs, up over 26%, and medical supplies have driven a $2 billion rise in overall expenses.

When preparing for medical sales in Colorado, doctors should look closely at profitability trends, staffing costs, and revenue composition. Buyers will scrutinize these numbers in a medical practice analysis, and strong data can help defend a higher sale price. Transparent reporting builds confidence, and confidence drives offers.

4. Market Consolidation and Private Equity Entry

Another force shaping medical market trends in Colorado is consolidation. Over the past decade, an increasing number of independent practices have joined large hospital networks or private equity groups, seeking predictable cash flow. Specialists in dermatology, orthopedics, and urgent care have seen the most considerable uptick in acquisition interest.

For sellers, consolidation cuts two ways. Competition from large systems can limit negotiating power, yet those same systems are active buyers. If your practice maintains steady earnings and loyal patients, it can appeal both to regional systems and investment firms. In this climate, sellers benefit by preparing early and presenting their business as a turnkey opportunity.

5. Urban Versus Rural Practice Dynamics

Healthcare in Denver, Boulder, and Colorado Springs operates under a different rhythm than in the San Luis Valley or Eastern Plains. Urban clinics face denser competition but benefit from larger payer networks and tech-savvy patients. Rural practices often hold stronger community ties and less direct competition.

Understanding these differences is central to medical practice analysis. For instance, a family medicine office in Gunnison might attract a higher value due to its limited local alternatives, while a specialist clinic in Denver might command a higher value for its efficiency and innovation. Each story is different, but location always influences price.

6. Technology, Telehealth, and Patient Expectations

Telehealth usage, electronic record systems, and patient-experience tools are now part of every valuation conversation. In Colorado, broadband expansion has helped rural clinics stay connected, making telemedicine more feasible. Buyers often assign premium value to practices that already use integrated EMRs, remote monitoring, or virtual consult systems.

These advancements also reshape healthcare opportunities in the state of Colorado. For instance, a cardiology practice that offers remote patient monitoring can expand beyond its immediate geographical area. For a seller, showcasing these digital tools can highlight resilience and forward-thinking operations, both of which buyers appreciate.

7. Preparing for Transition

Selling a practice involves more than listing a business. It requires early planning, clear financials, and professional support. Engaging specialists in medical sales in Colorado ensures compliance, confidentiality, and accurate valuation. A structured approach to contracts, staffing transitions, and buyer qualification can prevent costly setbacks.

If you are preparing to sell your medical practice, trust Strategic Medical Brokers to guide you through every step, ensuring you secure the best value for your Colorado medical practice with confidence.

FAQs

Colorado consistently ranks among the top ten states for overall healthcare quality, boasting strong preventive care but facing persistent challenges in rural access.

The most pressing challenge is workforce shortage, which strains patient access and increases operational costs for hospitals and small practices, especially in rural areas.

Physicians face rising administrative work, declining reimbursement rates, and competition with large integrated networks.

Population growth and aging residents increase demand for primary and specialty care, raising buyer interest in established clinics.

Final Thoughts

Colorado’s healthcare industry is changing rapidly, but opportunity remains strong for physicians who plan strategically. Staying informed about financial pressures, workforce gaps, and buyer trends can help you position your practice effectively. Every detail, from staff stability to patient loyalty, contributes to value. By preparing early and maintaining clean, verifiable records, you can navigate the process with confidence and clarity.

Planning to list your medical practice for sale in Colorado? Strategic Medical Brokers offers personalized strategies, market insights, and professional support to help you achieve the best possible outcome for your practice.