Figuring out the value of a medical practice in Florida can feel like navigating the state’s winding waterways; it takes knowledge and care to reach the right destination. Valuing a practice isn’t some secret formula; it’s a practical process that helps you make informed decisions. A precise valuation goes beyond spreadsheets, looking at patient mix, competition, payer contracts, and the character of the practice itself.

Ready to uncover the real value of your medical practice in Florida? This guide walks you through the process, from understanding financial performance to reviewing market conditions and expert analysis.

Table of Contents

ToggleWhy Value Your Florida Medical Practice?

Florida’s healthcare market is red-hot, with an aging population and a steady stream of tourists driving demand. Selling, merging, or simply curious, understanding the value of your practice gives you a solid foundation for every decision ahead.

The state’s mix of urban hubs like Miami and rural areas like the Panhandle creates unique valuation challenges. Plus, factors like insurance regulations and competition from hospital systems come into play. Understanding the valuation of healthcare companies allows you to steer your business wisely and maximize its opportunities.

Key Factors Impacting Practice Value in Florida

Before diving into methods, let’s talk about what shapes value:

1. Strong Financial Health

Low overhead, efficient staffing, and consistent revenue streams boost a practice’s worth. A financially healthy practice signals stability and profitability, making it far more attractive in the market.

2. Regulatory Compliance

Following the Florida Board of Medicine rules is essential. Any compliance issues or past violations can deter potential buyers, so maintaining a clean record is a key factor in valuation.

3. Intangible Assets and Goodwill

Loyal patients, a strong community reputation, and positive word-of-mouth create goodwill that can dramatically increase a practice’s perceived value. These intangibles often weigh as heavily as financial numbers.

4. Location and Growth Potential

Practices in growing communities or near expanding healthcare facilities often have higher valuations. Future growth potential can sway buyers willing to pay a premium for the opportunity.

5. Quality of Staff and Leadership

A skilled, stable team adds value by ensuring smooth operations after a sale. Experienced staff and strong leadership reduce transition risks, which buyers highly appreciate.

6. Technology and Infrastructure

Modern equipment, electronic health records, and efficient office systems signal a forward-thinking practice. These investments can justify a higher valuation and appeal to tech-savvy buyers.

These elements answer “How are medical practices valued for sale?” And set the stage for valuation methods.

Practice Valuation in Florida

Florida’s unique market calls for tailored approaches to the valuation of healthcare companies. Below are the proven methods to evaluate your practice:

1. Asset-Based Valuation Method

This approach tallies what your practice owns minus what it owes. Think equipment like X-ray machines, leased office space in medical plazas, or patient records. In Florida, tangible assets add up fast, especially for specialties like radiology. Intangible assets, like goodwill from a strong reputation in cardiology, also count. This method works well for practices with valuable assets but lower profits, like small clinics in Tampa.

2. Income-Based Valuation Method

Here, we focus on earnings to estimate future cash flow. Techniques like discounted cash flow adjust for risks, such as Florida’s hurricane season disrupting operations. Another option, capitalization of earnings, applies a rate to steady profits. This suits practices with consistent revenue, like dermatology or pediatrics in Orlando.

EBITDA (earnings before interest, taxes, depreciation, and amortization) is a key metric that highlights profitability. This method often uncovers hidden value in efficient practices addressing strong patient demand, streamlined operations, and low overhead, giving a clearer picture of what a buyer might be willing to pay.

3. Market-Based Valuation Method

The market approach determines a medical practice’s value by examining how comparable practices are performing. It takes into account recent sales, adjusting for differences in size, location, specialty, and patient base to provide an accurate estimate.

This approach works best in active markets where recent transactions provide solid benchmarks. In areas with fewer sales or unique specialties, valuators rely on local market trends, patient demographics, and payer patterns to fine-tune the estimate, ensuring the final value reflects both reality and potential.

Understanding EBITDA Margins in Healthcare

EBITDA is a way to measure a company’s profit from its core business operations without including costs like loans, taxes, or significant accounting adjustments. It shows how much money the business actually makes from running its day-to-day activities.

Let’s zoom in on what a good EBITDA margin in healthcare is. This metric shows profitability as a percentage of revenue after core expenses.

In 2023, as per Definitive Healthcare, the average hospital reported an EBITDA of approximately $1.4 million, a significant rebound from 2022, when the average was -$358,332, likely due to reduced capacity, delayed care, and rising costs stemming from the COVID-19 pandemic.

In 2024, payers focused on strategic deals within their sector and selected care services to expand coverage, improve efficiency, and reduce healthcare costs. According to McKinsey, payers in 2024 pursued a focused deal strategy, constrained by EBITDA pressures. Over half of transactions targeted same-sector consolidation to boost coverage and efficiency, while select investments in home health and ambulatory surgery centers aimed to lower care costs.

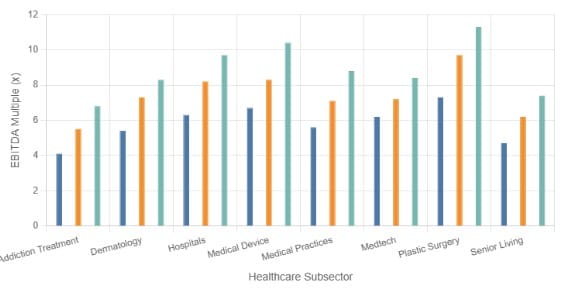

Role of Valuation Multiples in the Healthcare Sector

Healthcare valuation multiples are critical for setting sale prices. These ratios depend on specialty and location. These multiples refine your understanding of how to calculate the value of a medical practice, especially in competitive areas.

This bar chart illustrates EBITDA multiples for private healthcare companies in 2025. Non-essential healthcare subsectors like plastic surgery and medical devices had the highest but more volatile multiples, fluctuating with economic trends. In contrast, addiction treatment and senior living showed lower yet more stable valuations.

Preparing for a Valuation and Maximizing Your Practice’s Value

To answer “How can you figure out the net worth for your practice?”, start with clean financials. Pull three years of tax returns, balance sheets, and patient data. Online calculators offer rough estimates, but pros fine-tune them. Timing matters too; sell when profits peak, not during dips. Florida’s telemedicine boom can also enhance value, especially for practices offering virtual care.

Valuing and selling a practice is complex. Expert medical business brokers, like Strategic Medical Brokers, bring deep knowledge of healthcare deals, from finding buyers to handling legal details.

Want to boost your practice’s worth? Streamline operations, reduce overhead, and document compliance. Highlight unique strengths, like a niche in sports medicine or a prime location.

FAQs

Collect tax returns, financial statements, patient lists, and lease details to start.

Expect a few weeks, depending on data complexity and availability.

Absolutely, specialties like oncology often fetch higher multiples in Florida.

You can get a rough idea, but professionals ensure precision and compliance.

Healthcare professionals recommend Strategic Medical Brokers because we provide expert guidance and tailored solutions for buying or selling medical practices, ensuring smoother transactions, accurate valuations, and maximum return on investment.

To Wrap Up

Valuing a medical practice in Florida blends practical math with market savvy. Use asset, income, and market-based methods, keep an eye on what is a good EBITDA margin in healthcare, and lean on experts to guide you. No matter if you’re selling or planning, understanding how medical practices are valued for sale empowers you to make smart moves in Florida’s dynamic market.

Ready to take the next step? Contact Strategic Medical Brokers for expert guidance on your practice transition. We showcase your practice’s strengths to buyers, ensuring top dollar for your medical practice for sale in Florida.