Georgia’s healthcare sector is a powerhouse, pumping billions into the state economy. The healthcare market in the state is shifting in ways that really matter to sellers, buyers, and brokers. This growth draws investors, but it also means more competition. Sale prices for practices can climb when the market looks strong, yet factors like high uncompensated care in rural areas drag them down.

Table of Contents

ToggleWhat Are the Five Trends in Health Care That Are Shaping Sales?

Let’s get into the heart of it. People often ask, ‘What are the five trends in healthcare making waves in Georgia?’ Here are the five big ones that directly hit sale prices. These aren’t just buzzwords. They’re real shifts that can boost or bust a deal.

Trend 1: Soaring Operational Costs

Costs are rising everywhere, and healthcare seems increasingly challenging. According to MGMA, in 2025, medical practice leaders reported an average increase in operating expenses of approximately 11.1 percent compared to the previous year.

Think staff salaries, supplies, and even malpractice insurance. This trend squeezes margins, which in turn lowers what buyers are willing to pay. If your practice has lean operations, though, it stands out. Buyers value efficiency, which can potentially lead to higher sale prices. However, ignoring this could lead to an undervaluation of your asset.

Trend 2: Consolidation Through Mergers and Acquisitions

M&A is hot in Georgia. In Q2 2025, the healthcare market saw bustling activity, especially in physician practices and home health. Deal values increased from $63 billion in 2023 to $69 billion in 2024, with private equity leading the charge.

This means smaller practices are getting scooped up, often at premiums if they’re in high-demand areas like Atlanta. However, regulatory blocks and inflation can stall things, keeping prices in check. For sellers, timing is key. Ride the wave, and your sale could net more. Miss it, and you face a crowded field.

Trend 3: Workforce Shortages and Growth

Healthcare jobs are booming in Georgia, but shortages persist. The state hit a milestone with over five million jobs total, led by health care, adding 24,300 positions in a single year. This growth fuels the economy, but it also ramps up labor costs.

Practices struggling to hire might see lower valuations because buyers factor in recruitment expenses. On the flip side, a well-staffed operation with low turnover can command higher prices, as it promises stability.

Trend 4: Tech Integration

Tech is changing the game. In 2024, AI for diagnostics and remote care are top priorities. Georgia’s push for better access in rural spots means practices with solid telehealth setups are more attractive. This can lift sales prices by showing future-proofing. But if your setup lags, buyers might discount for upgrades, cutting into your payout.

Trend 5: Policy and Regulatory Changes

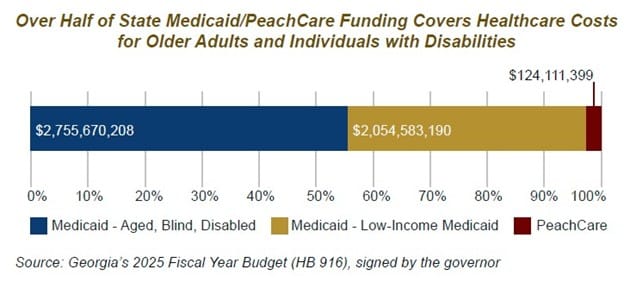

The Department of Community Health (DCH) plays a significant role in Georgia’s healthcare system. Because DCH has a broad reach, any change in its policies directly impacts how practices operate and their value. Currently, policies surrounding Medicaid and coverage gaps are sparking considerable discussion. A possible expansion could mean more jobs and increased access to care.

Practices that stay compliant and adjust quickly to these changes often sell for higher prices, while those slowed down by red tape may see their value decline.

Chart Source: GBPI

This chart shows how Georgia’s Medicaid and PeachCare funding is allocated for 2025, based on the state’s budget.

What Are the Economic Trends in Healthcare?

Now, shifting gears a bit, what are the economic trends in healthcare in Georgia? Inflation and interest rates are significant players. They’ve slowed some deals, but the sector still grows. The average cost of employer-sponsored health care coverage is projected to rise 9% in 2025. This trend pushes practices to cut fat or risk lower sales values.

Broader economic trends in healthcare include a focus on affordability, with consumers demanding value. In Georgia, this means buyers scrutinize earnings potential closely before making a bid.

What Are the Economic Factors in Healthcare?

Diving deeper, what are the economic factors in healthcare affecting sales? Demographics top the list, with an aging population spiking demand but straining resources. Rural challenges, such as low patient volumes and high uncompensated care, hurt valuations in these areas. Then there’s investment income. Many hospitals rely on it to stay profitable, but market dips can erode that buffer. Economic factors affecting the healthcare industry also include trade policies and housing shifts, which indirectly influence job growth and patient bases. In Georgia, these create a mixed bag: opportunity in urban hubs, caution in outlying areas.

How Healthcare Employment Numbers Impacted the Economy?

One area that’s fascinating is how healthcare employment numbers impacted the economy in Georgia. Healthcare employment in Georgia has been rising consistently over the past decade. The sector now accounts for a significant share of jobs in many counties. That growth means more spending in local economies on food, housing, and services. Practices that show robust growth in staff or revenue signal a healthy business model. Buyers see derivative benefits in community economic strength. When you show employment growth, it implies resilience and pulls more interest at higher price points.

If you’re navigating a sale, chatting with medical business brokers like Strategic Medical Brokers can help sort through these dynamics.

U. S. Healthcare Industry Statistics and Their Relevance

Let’s zoom out for a moment. Examining U.S. healthcare industry statistics provides a clearer picture of why practices in Georgia are selling for the prices they are.

The United States spent more than 17.6 percent of its GDP on healthcare in 2023. That represents a massive share of the national economy, highlighting the significant value people place on medical care.

Healthcare is also one of the fastest-growing job sectors in the country. For sellers, this means that practices become more appealing assets since they are part of a growing industry that drives steady employment.

Together, these statistics set the stage for local valuations. They show that the healthcare sector is dynamic, constantly reshaping itself in ways that reward practices that stay ahead. When you connect these national figures to the Georgia market, it becomes clear why buyers are willing to pay more for practices that demonstrate growth, adaptability, and stability.

FAQs

Rising costs can lower valuations if they erode profits, but efficient practices often maintain or even increase their appeal to buyers.

It can be, as larger entities pay premiums for strategic fits, but it also means more competition during sales.

Technologies like AI can boost prices by showcasing innovation, while outdated systems may lead to discounts for necessary updates.

Stable, skilled staff lower transition risk for buyers. Practices that already have an experienced team and low turnover often sell at a premium.

Final Thoughts

Wrapping this up, Georgia’s healthcare trends are a wild mix of challenges and chances that directly sway sale prices. From cost pressures and M&A buzz to workforce booms and policy tweaks, staying ahead means watching these closely. Practices that adapt, like by embracing tech or streamlining ops, often see the best outcomes. Ultimately, the market rewards resilience. If you’re in this space, now’s a good time to assess where your practice stands amid these shifts.

Ready to make your next move? Reach out to Strategic Medical Brokers for personalized advice on buying or selling. Their team can guide you through the process with ease.