With Austin buzzing with tech professionals, young families, and retirees all seeking reliable healthcare, the demand is clear. But putting a value on a medical practice isn’t as straightforward as pricing a home. It’s a blend of complex numbers, market dynamics, and local factors.

In this guide, we’ll break down the essentials, from how to value a medical practice to using medical practice valuation multiples. By the end, you’ll have a clearer picture of how to approach the process with confidence.

Understanding the Basics of Medical Practice Valuation

When we talk about medical practice valuation, we are essentially looking at what makes a clinic appealing to buyers, investors, or even partners. Unlike traditional businesses, medical offices have two types of value. The first is tangible, which includes assets such as equipment, furniture, and the building if it is owned. The second is intangible, often called goodwill, which refers to things like patient loyalty, brand reputation, and community standing.

If you are asking yourself what the rule of thumb is for medical practice valuation, most experts would say it often falls within a percentage of the practice’s annual revenue or a multiple of earnings. A common rule of thumb for medical practices is to multiply the annual gross revenue by a factor of 0.5 to 1.5, according to ArrowFish.

However, rules of thumb only provide a rough guideline. Every clinic in Austin is different, and the actual value can vary widely depending on location, specialty, and the patient base.

Common Methods for Medical Practice Valuation

1. Adapting Valuation Methods to Austin’s Healthcare Market

Start with the basics. There are three main ways to approach medical practice valuation:

- The income method looks at future earnings. You project profits, adjust for risks, and discount them to today’s dollars. This fits well for steady practices in Austin, where consistent patient visits drive revenue.

- The market method compares your setup to similar ones sold recently. Checking sales data for clinics in Texas or nearby states provides a clear picture of what buyers are willing to pay.

- The asset method tallies up tangible items like exam tables, computers, and real estate, minus debts. It’s handy for asset-heavy spots, but often undervalues goodwill, that invisible pull from your reputation.

In Austin, these methods adapt to local factors. For instance, a practice near the University of Texas might fetch more due to student health needs. Always blend methods for accuracy as combining them leads to balanced outcomes, avoiding over- or underestimates.

2. Using EBITDA to Frame the Conversation

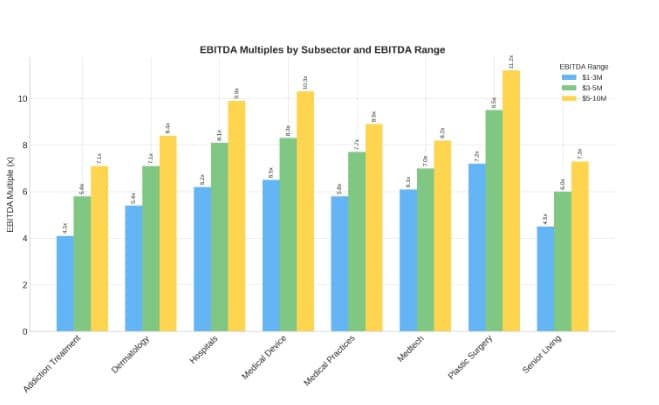

Earnings before interest, taxes, depreciation, and amortization, or EBITDA, stands out in physician practice valuation. It strips out non-operating costs to show core profitability. Many buyers apply an EBITDA multiple that medical practice owners find helpful, because it translates financial performance into a practical market value. By multiplying EBITDA by an industry benchmark, owners can gauge what their practice might sell for and compare it with similar deals in the region.

For example, a dermatology clinic, plastic surgery, and Medtech with strong margins hit higher multiples, as per the recent data from HealthValue Group. This metric helps in healthcare business valuation by focusing on operational strength, ignoring one-time expenses.

Chart Source: HealthValue Group

Apply it carefully in Austin. High living costs and competition from big systems can tweak these figures if your practice has recurring revenue from subscriptions or wellness programs, which boosts the multiple.

Remember, medical practice valuation multiples can shift from year to year. A 2025 report from FirstPageSage placed average revenue multiples for private healthcare practices between 2.6 and 3.3 times.

3. Analyzing Austin’s Unique Market Forces

Another part of the equation in healthcare business valuation is the city itself. Austin has unique market forces that make it different from other parts of Texas. Rapid population growth means there is no shortage of patients. But that also comes with increased competition, as more doctors are attracted to the region.

Austin’s unique pulse shapes how to value a medical practice. The city’s tech influx means more insured patients through employers like Dell or Apple. The tech-driven workforce and younger population often look for clinics that offer digital access, such as online booking or telehealth. Practices that already integrate these features may be worth more. Retirees, on the other hand, often prioritize continuity of care and trust in physicians. Practices with long-term patient relationships can see more substantial goodwill value.

4. Considering Regulations and Market Growth

When looking at the value of a medical practice in Austin, it pays to study the landscape around it. Texas has a relatively friendly legal environment for providers, with caps on malpractice awards that reduce risk compared with more lawsuit-heavy states. That stability can make practices here more appealing to buyers.

Growth adds another layer. Census data shows the Austin metro has expanded by more than 20% over the last decade, and that steady rise in residents translates into consistent demand for healthcare. Specialties tied to the city’s energetic lifestyle, like orthopedics and sports medicine, often see higher demand, which can boost their worth.

Intangible elements matter too. A practice with a strong online reputation, ties to community groups, or staff who reflect Austin’s diverse population often enjoys extra goodwill. Healthcare practice brokers, like Strategic Medical Brokers, use these strengths to help sellers position their clinics for premium offers.

Steps to Calculate Medical Practice Value

Ready to crunch numbers? Here’s a practical guide on how to calculate medical practice value.

- Gather financials: three years of statements, tax returns, and payer breakdowns. Adjust for owner perks, like personal vehicle expenses, to normalize earnings.

- Choose your method: the income approach, which projects future profits and discounts them to present value; the market approach, which compares your practice with similar recent sales; and the asset approach, which totals equipment, furnishings, and property, then subtracts liabilities.

- Test with multiples: Apply an EBITDA multiple medical practice benchmark, say 4 times for a solid Austin family clinic. Tools like Physicians Thrive’s calculator offer quick insights, but pros refine them.

- Get external help: Certified valuators ensure compliance, especially for tax purposes. In Austin, firms familiar with Texas laws avoid pitfalls. Loop in medical practice valuation multiples again for cross-checks. If revenue multiples align with EBITDA multiples, you’re golden. This holistic view powers smart decisions.

FAQs

It usually spans four to eight weeks, depending on complexity and data availability. Rush jobs might cost extra.

Absolutely, spots near high-traffic areas like downtown or the Domain often see higher values due to accessibility and patient density.

They can lower multiples temporarily, but essentials like healthcare rebound quickly, especially in growing hubs like Austin.

Yes, it covers reputation and patient loyalty, which can represent a massive share of the overall value in well-established practices.

To Wrap Up

Figuring out the value of a medical practice in Austin boils down to smart methods, local savvy, and solid data. From EBITDA tweaks to market comps, each piece fits the puzzle. Austin’s growth offers opportunities, but details decide the final number. Approach it thoughtfully, and you’ll navigate sales or buys with ease. Remember, values fluctuate, so stay updated.

Looking for a medical practice for sale in Texas to take the next step? Connect with our experts at Strategic Medical Brokers today for personalized advice, advanced valuation, and seamless transactions.