Colorado’s healthcare scene is changing fast. Rising demand, growing costs, and an influx of investors mean physicians are seeing new opportunities and challenges. Private equity is now an active player in Colorado’s healthcare scene, changing the rules of the game for physicians. Understanding these shifts now can help doctors make informed choices before opportunities knock.

Table of Contents

ToggleA Quick Look at Colorado’s Demographics and Healthcare Market

Colorado combines rapid population growth (around 5,773,714) in 2025, a strong outdoor lifestyle culture, and a higher-than-average rate of insured patients. The state ranks in the top ten for median household income ($97,113) and boasts lower unemployment, which translates into reliable reimbursement. Add world-class destinations like Denver, Boulder, and Colorado Springs, and you get a market that PE firms find hard to ignore.

Rapid population growth and rising incomes fuel demand for healthcare services, while high insurance coverage ensures consistent revenue streams, making Colorado an attractive market for investors and healthcare buyers alike.

Colorado’s Legal Boundaries for Private Equity Healthcare Acquisition

In Colorado, medical practices are regulated to ensure that physicians retain clinical control. PE firms cannot directly employ physicians in a way that compromises medical decisions, because the state enforces Corporate Practice of Medicine Laws. Key points include:

- Physician Control: Only licensed doctors can own medical practices or control medical decisions. PE firms may invest through management agreements or hold non-medical corporate interests, such as facilities or administrative services.

- Professional Corporations: In Colorado, medical practices can operate as professional corporations (PCs). PE investors can own shares in management or administrative entities, but not in the PC itself that delivers medical care.

- Anti-Referral and Compliance: Private equity arrangements must comply with the Stark Law and anti-kickback rules. PE involvement cannot influence clinical referrals or care decisions.

- Structuring Buyouts: Common structures include management service organizations (MSOs), in which the PE firm provides administrative support while physicians retain ownership and control of patient care.

- Licensing and Liability: Physicians remain personally responsible for the quality of care they provide. PE firms cannot assume malpractice liability but can provide operational resources.

Essentially, PE firms can invest in Colorado medical practices, but ownership is limited to administrative, non-clinical aspects, while physicians keep clinical authority.

Why Private Equity is Interested in Colorado Healthcare

Private equity firms often target small, high-revenue clinics, completing PE buyouts for medical practices to consolidate operations, streamline administration, and generate predictable returns while physicians maintain clinical responsibilities.

Investing in physician practices appeals to investors because healthcare remains a business with strong demand, recurring revenue, and frequent consolidation. The appeal grows especially in settings like Colorado, where markets are stable, and demand remains high.

1. Efficiency and Scale

Buying smaller solo or group practices gives investors a chance to combine them, reduce overhead, and standardize administration. These efficiencies can improve margins across multiple sites.

2. Predictable Cash Flow

Medical practices often generate steady, recurring income from patient care, procedures, and reimbursements. That steady cash flow is attractive to firms used to predictable returns.

3. Market Fragmentation Offers Opportunity

U.S. healthcare remains fragmented. According to an article published in Health Affairs, there were 5,779 physician practices owned by private equity firms in 2021, up sharply from just 816 in 2012, across the Metropolitan Statistical Area. Fragmentation means many smaller practices may be open to acquisition, consolidation, or sale, making a region like Colorado a promising target.

4. Growing Consolidation Trends

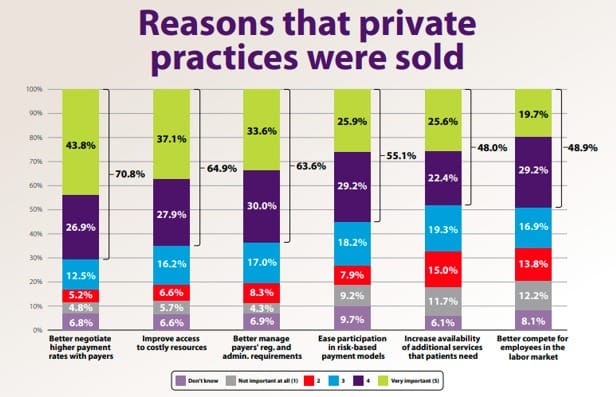

According to a study by the American Medical Association, among independent physicians who sold their practices in the last decade to hospitals, PE firms, or insurers, the primary motivations reveal clear priorities driving consolidation.

Chart Source: American Medical Association

Physicians sell private practices primarily to secure higher reimbursements, ease administrative burdens, and improve access to resources, with financial negotiation power ranking as the dominant driver over labor-market or risk-based payment concerns.

As consolidation continues, private equity firms often step in to buy or merge practices, offering resources that smaller practices sometimes lack.

5. Investment Returns and Exit Strategy

Private equity firms aim to optimize operations, then sell or merge at a profit in a few years. Healthcare practices with stable revenue and growth potential make attractive candidates for such buyouts. This drive underlies the increased practice acquisitions in Colorado over recent years.

In addition, the combination of stable demand, fragmentation, and rising consolidation makes healthcare in states like Colorado appealing to investors who recognize long‑term opportunity.

What Physicians in Colorado Should Expect (If PE Comes Knocking)

If you are running a private practice in Colorado, you should be prepared for several possible changes if a private equity group becomes involved.

- You might be offered a buyout by PE firms for your medical practice. That could mean a lump Sum up front and potential earn‑outs or equity in a larger entity.

- Practice culture might shift: management could centralize billing, staffing, scheduling, or other administrative tasks. That can relieve overhead, but may reduce autonomy.

- There may be pressure on productivity, patient volume, and revenue metrics as the new owner seeks returns. That could shift focus from care to efficiency.

- Prices for patients and insurers might increase, especially if consolidation reduces competition.

- For doctors who stay on, employment conditions may change. Ownership stakes may vanish or diminish, replaced by salaried or contracted work under the new owner.

Selling a practice can feel like a big relief from administrative stress, but it also means giving up control and potentially seeing changes in how care is delivered. Strategic Medical Brokers help sellers showcase their practice, making it visible to buyers, including private equity firms actively searching for a “medical practice for sale near me.”

How to Make Your Practice More Attractive for a Buyout

If you are open to a sale or acquisition, you can take steps now to position your practice well for potential interest.

- Keep financials clean and transparent. Clear accounting and stable revenue make due diligence easier.

- Document patient volume trends, payer mix, referral networks, and operational workflows. Investors value practices that run smoothly and have growth potential.

- Reduce dependencies on a single physician or a small team. A diversified provider base signals sustainability.

- Invest in digital records, efficient billing systems, and compliance. These signals readiness for scaling and integration.

- Maintain relationships and contracts with insurers and networks. That helps buyers see continuity of income and less risk.

By doing these things, you improve the odds for a smooth medical acquisition in the Colorado market under fair terms.

FAQs

Private equity sees healthcare as a stable business with recurring patient demand, fragmented ownership, and strong potential for consolidation and profit.

According to a report in the American Medical Association, as of 2024, around 6.5% of U.S. physicians work in practices owned by private equity firms.

Doctors working for private equity are typically employed through larger corporate‑owned practices rather than owning their own clinics.

Doctors often gain back-office support but lose business autonomy. Changes can include new management, strict performance metrics, and a focus on expanding profitable services.

It depends entirely on your goals. It can provide capital and reduce administrative stress, but it also means ceding control and adapting to a corporate structure and its financial objectives.

Wrap-Up

For Colorado physicians, the landscape of practice ownership is shifting. The arrival of private equity marks a significant new chapter, marked by both growth potential and complex considerations. This evolution in the medical acquisition in the Colorado market is now a defining feature of the state’s healthcare environment. Navigating it successfully demands your proactive engagement, a clear-eyed assessment of your professional goals, and a trusted advisory team.

Strategic Medical Brokers makes it simple to list and market your medical practice for sale in Colorado, attracting serious buyers and private equity firms interested in quality healthcare investments.