Arizona is witnessing a demographic shift that’s reshaping the medical landscape. With retirees flocking to sun-soaked cities and quieter communities alike, the state’s aging population is creating unprecedented demand for healthcare services. For practice owners, this is an opportunity. Clinics that cater to senior patients are becoming highly sought after, driving a surge in medical practice sales across Arizona as buyers recognize both the stability and growth potential in this evolving market.

In this blog, we’ll explore Arizona’s growing senior population and how it connects to opportunities for selling your practice.

Table of Contents

ToggleUnderstanding Demographics in Arizona

Let’s start with the basics of who’s living in Arizona. The demographics in Arizona paint a vivid picture of a state that’s diverse and expanding. With a total population hovering around 7.5 million, as per the United States Census Bureau, Arizona ranks as one of the fastest-growing spots in the U.S.

A big chunk of that growth comes from people moving in from other states, drawn by the sunny weather and lower costs compared to places like California.

Demographics and Population Profile of Phoenix

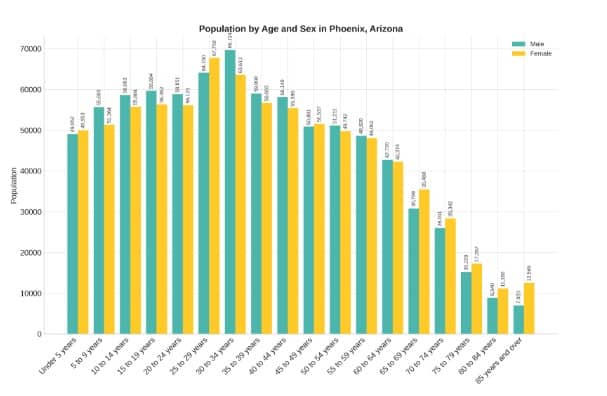

When you zoom in on the population of Phoenix, Arizona, according to the United States Census Bureau, it’s clear why this city leads the pack. Phoenix boasts about 1.67 million residents, making it the largest city in the state and the fifth-biggest in the country.

The demographics in Phoenix, Arizona, show a mix of young professionals, families, and retirees. In 2025, Phoenix’s population is relatively young, with a median age of 34.4 years. The breakdown is 24.2% under 18, 61.3% between 18 and 64, and 14.5% aged 65 or older; a mix that fuels the city’s energetic workforce.

Demographics and Population Profile of Other Cities

Breaking it down further, the population of Arizona by city reveals some interesting contrasts, as per Arizona Demographics. After Phoenix, Tucson comes in at around 554,013 people, followed by Mesa with 517,151, Gilbert with 288,790, and Chandler with 281,231.

Smaller cities like Scottsdale and Glendale add to the mix, each with its own pockets of older residents. These urban areas are where most of the action happens in terms of medical services.

Rank | City | Population |

1 | Phoenix | 1,673,164 |

2 | Tucson | 554,013 |

3 | Mesa | 517,151 |

4 | Gilbert | 288,790 |

5 | Chandler | 281,231 |

6 | Glendale | 258,143 |

7 | Scottsdale | 246,170 |

8 | Peoria | 199,924 |

9 | Tempe | 190,114 |

10 | Surprise | 167,564 |

Age Distribution Across the State

According to America’s Health Ranking, about 19% of Arizonans are 65 and up, which is higher than the national average in some metrics. This group is expected to keep growing as baby boomers retire and more snowbirds settle in permanently.

Arizona’s population is steadily aging, with more retirees settling permanently and shaping the state’s communities. Many areas, especially popular retirement spots like Sun City and parts of Phoenix, attract older adults looking for warmer climates. Phoenix continues to grow quickly, drawing people of all ages, while nearby suburbs and southern cities see higher concentrations of seniors.

Alongside this, Arizona remains racially and culturally diverse, with varied groups contributing to its social and economic landscape. Overall, older residents are becoming an increasingly important part of local services, particularly healthcare.

How Arizona’s Older Demographics Drive Practice Transactions?

The rise in older residents isn’t just a statistic; it’s reshaping the medical landscape and creating prime conditions for practice sales. Doctors nearing retirement or looking to scale back find eager buyers, often larger groups or hospitals hungry for established setups.

Here’s why this demographic shift is lighting a fire under the market.

1. Increased Demand for Specialized Care

With more seniors comes a spike in needs for things like geriatrics, cardiology, and orthopedics. Practices that cater to these areas are hot commodities. Buyers see the built-in patient base as a goldmine. This demand shortens sales times and boosts values, making it a seller’s market in many spots.

2. Retiring Physicians Align with Market Needs

Many current practice owners are themselves part of that aging wave. As they hit their 60s and 70s, they’re ready to step away, but the influx of older patients means their businesses are more valuable than ever.

Working with experienced medical brokers, like Strategic Medical Brokers, can smooth this transition, connecting sellers to buyers who appreciate the established reputation and steady revenue from senior care.

3. Population Growth in Key Cities Amplifies Opportunities

The data from the Arizona population by city shows concentrated growth in urban centers, where healthcare infrastructure is robust. In Phoenix and Tucson, the expanding senior numbers mean practices there sell quicker. Buyers, from private equity to hospital systems, want in on this stable, growing patient pool driven by the state’s demographics.

4. Economic Factors Make Sales Appealing

Arizona’s lower taxes and cost of living attract retirees, but they also make running a practice highly profitable. When selling, owners can command higher prices because buyers understand the strong local economics and the predictable patient demand, making investments more secure and financially rewarding in the long term.

5. Strategic Transitions for Long-Term Stability

As the demographics in Arizona evolve, practices that adapt to senior-focused services become prime targets for acquisition. Sellers benefit from timelines that align seamlessly with their retirement plans, while buyers gain a valuable foothold in a rapidly growing healthcare sector. This strategic synergy explains why sales activity is steadily accelerating across the state, creating opportunities for all stakeholders.

FAQs

Yes, Arizona definitely has a growing number of older residents, with about 19% of the population aged 65 and above, and projections show this group expanding rapidly.

As the number of seniors in Arizona grows, demand for healthcare services increases. This rising demand makes practices more attractive to buyers, often driving higher sale prices and quicker transactions.

Based on recent estimates, Arizona’s median age is 39.4 years, slightly higher than the national median of 39.2 years, indicating a marginally older population compared to the U.S. overall.

Typically, with Strategic Medical Brokers, many practices sell within a few months to a year, due to the targeted approach and high success rate.

The average timeline for a medical business sale in Arizona ranges from six to 12 months, depending on factors like practice size, location, and market conditions.

With the state’s expanding senior population driving healthcare demand, sellers can often achieve higher valuations and faster closings in the current market.

Final Thoughts

Arizona’s shifting age groups are more than numbers on a page; they’re a catalyst for change in the medical world. With more retirees settling across the state, healthcare practices are seeing growing opportunities and heightened demand. If you’re pondering your options, now might be the perfect time to act, given the strong market pull from these trends and the increasing demand for healthcare services tailored to an aging population.

Take the next step: secure your medical practice for sale in Arizona with expert guidance every step of the way. Contact Strategic Medical Brokers today for a confidential consultation on selling your practice!