Healthcare in Texas is gearing up for a transformative year ahead. By 2026, the state’s medical landscape is expected to look very different: more digital, more connected, and more competitive. Hospitals are adapting to rapid tech advancements, telehealth is becoming a household norm, and investment interest is surging as the population continues to climb. Between new funding for rural care, workforce challenges, and real estate growth around healthcare hubs, the Texas healthcare market is poised for significant change.

Table of Contents

ToggleHealthcare Growth and Shifts in Texas: 2026 Market Forecast

Let’s focus on the key points: the shifts defining the Texas healthcare marketplace as we head into 2026. Continue reading to learn the details of how the Texas healthcare market is evolving in 2026, what factors are shaping its future, and where the most significant opportunities and challenges lie for providers, investors, and entrepreneurs.

1. Surging Premium Costs in the Marketplace

Costs are climbing like kudzu in July. The Texas healthcare marketplace is expected to face average premium hikes of 24% for 2026 plans, according to filings from The Texas Tribune. This increase is mainly because special federal tax credits, which help lower insurance costs, are ending soon, which means many people may have to pay twice as much each month.

As a result, hospitals expect more patients who can’t afford to pay for care, putting extra strain on their budgets. The Texas Business Healthcare Association and other groups are working on ways to ease the impact by promoting smarter contracts and cost-sharing strategies. At the same time, this challenge is opening doors to more affordable care options, such as direct primary care clinics, which are gaining popularity in Texas suburbs for offering simpler, budget-friendly healthcare plans.

2. Tackling Workforce Gaps Head-On

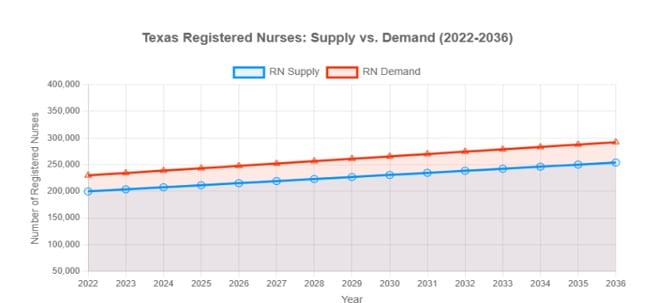

Next, the human element: we’re short on hands. According to the Texas Center for Nursing Workforce Studies, between 2022 and 2036, the supply and demand for registered nurses (RNs) are both expected to increase by approximately 27%. During this period, the projected unmet demand is anticipated to remain between 15% and 16%.

In other words, even though many more nurses will enter the workforce, and many more nursing positions will open, the increase in supply will not catch up enough to fully meet demand. This results in gaps in coverage, increased stress on existing staff, and challenges, particularly in underserved and rural areas.

The reasons behind this gap include retirements, burnout, attrition, geographic maldistribution, and limitations in training capacity (school slots, clinical placements, faculty). Texas also faces the challenge of scaling up nursing education and clinical training to produce a greater number of new nurses.

3. Integrating Technology and Artificial Intelligence

AI and wearables are no longer sci-fi; they’re now standard in Dallas labs and San Antonio clinics. A recent Vizient Member Networks survey found that across healthcare organizations, improving operational efficiency (88%) and achieving better quality outcomes (82%) are the leading reasons for developing AI and analytics strategies. Clinical decision support tools are also quickly becoming a top priority, signaling a shift toward smarter, data-driven care that enables providers to make faster and more accurate decisions in the coming years.

Big Texas healthcare companies, such as Baylor, are piloting robot-assisted surgeries. This wave boosts efficiency but demands upskilling.

4. Boosting Rural Access Across Texas

Texas’s vast spaces mean that urban glitz often overshadows the needs of backroads. According to the HHS, the federal government has announced a $50 billion program aimed at enhancing healthcare access in underserved and rural areas. The funding will be distributed to approved states over a five-year period, with $10 billion available annually starting in fiscal year 2026.

This initiative is designed to help bridge the growing healthcare gap between urban and rural Texas communities by supporting the establishment of new clinics, expanding telehealth infrastructure, and incentivizing providers to serve in remote areas where medical access remains limited.

5. Shifting Supply Chains and Managing Costs

Texas healthcare companies are looking forward to localizing their sourcing, with Houston hubs stocking generic medications to mitigate global supply chain disruptions, according to the NCBI.

It means Texas healthcare providers are starting to buy and produce more supplies within the state instead of depending on international suppliers. This move helps them avoid delays and shortages caused by global disruptions. As a result, new local businesses that manufacture or distribute medical supplies are emerging and growing, creating more investment and expansion opportunities within Texas.

6. Expanding Outpatient, Home, and Telehealth Services

The shift to outpatient, home, and telehealth services is significantly reshaping the Texas healthcare market. It’s about meeting people where they are, both literally and figuratively, while keeping costs down and maintaining high-quality care. From quick surgeries to virtual check-ins for rural folks, this trend is making healthcare more accessible and affordable.

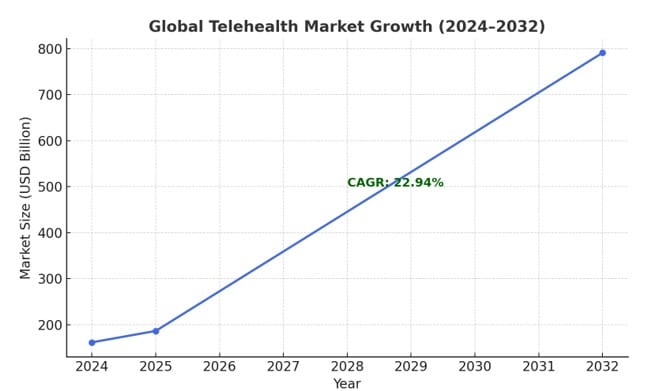

According to Fortune Business Insights, the telehealth sector continues to gain ground as healthcare systems adapt to digital-first care models.

This chart shows that the global telehealth market is expected to grow rapidly from $161.64 billion in 2024 to $791.04 billion by 2032, reflecting a CAGR of 22.94%; a strong indicator of sustained demand and innovation in digital healthcare.

If you’re in the Texas healthcare marketplace, this is your chance to carve out a niche. It’s a goldmine of opportunity, whether you’re launching a startup or eyeing a medical practice for sale in Texas. Stay nimble, keep an eye on regs, and you could ride this wave to some serious wins.

Understanding The Healthcare System in Texas

What is the healthcare system like in Texas? Texas’s healthcare system is a vast patchwork that combines top-tier urban hospitals with significant gaps in rural areas. In cities like Houston, Dallas, and Austin, world-class research hospitals and specialty clinics offer advanced treatments, attracting medical professionals from across the nation.

However, rural areas continue to face challenges, including limited access to healthcare providers, long travel distances for specialized care, and hospital closures. The state’s focus is gradually shifting toward expanding Medicaid-managed plans, telehealth adoption, and workforce development to bridge these gaps and ensure that quality care reaches every corner of Texas.

Frequently Asked Questions

Yes. Validate a small clinic, remote service, or supply line, build credibility, then expand. Many successful entrants begin modestly and scale when demand is proven.

Yes, the healthcare sector remains one of the most resilient and promising areas for investment. The need for healthcare keeps increasing as the population grows, people live longer, and medical technology continues to advance. In Texas, this demand is further amplified by the state’s rapidly growing population and expanding healthcare infrastructure.

A mix of rising costs, new tech, and a push for easier access is shaking things up. People want care that’s convenient, like telehealth or outpatient clinics, and the Texas healthcare marketplace is adapting to meet those needs, especially in far-flung rural areas.

Starting a medical supply business in Texas typically costs between $50,000 and $150,000 for a small operation, covering essentials such as business setup, initial inventory, and marketing.

Yes, Texas’s 2025 real estate market thrives due to rapid population growth and economic booms, especially in Dallas. Healthcare expansion boosts demand for commercial and residential spaces, with surrounding areas appreciating. Rural land offers opportunities for new healthcare facilities.

Final Thoughts

Texas in 2026 is going to be a demanding but promising frontier for healthcare. The Texas healthcare sector is under stress from rising insurance costs, rural access gaps, workforce shortages, and payer complexity. But pressures often breed opportunity. Firms that move smart, specialize, maintain compliance, and connect with systems may find strong returns.

The Texas healthcare market won’t slow down, and neither should you. Keep an ear to the ground, and who knows? You might spot your next big move in the mix.

If you’re considering expansion, speaking with seasoned medical brokers can help clarify the process. They navigate valuations and regs, turning headaches into handshakes. Swing by Strategic Medical Brokers for guidance on acquisitions and growth.